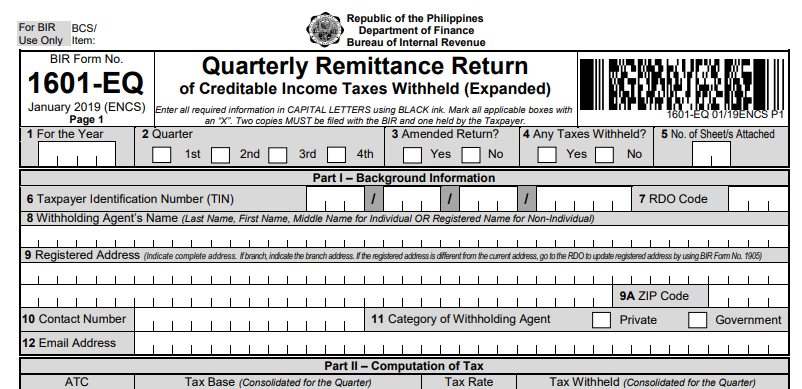

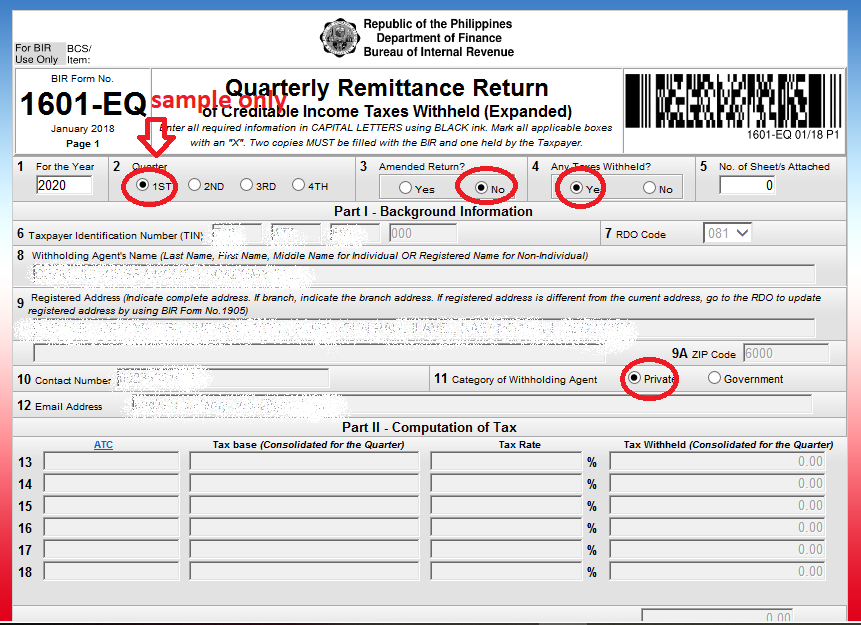

BIR Form 1601-EQ or the Quarterly Remittance Return of Creditable Income Taxes Withheld

Is used on remitting taxes that are withheld during the 3rd month of each taxable year.

Who must file?

- This quarterly withholding tax remittance return shall be filed by every Withholding Agent (WA)/payor required to deduct and withhold taxes on income payments subject to Expanded / Creditable Withholding Taxes.

Deadline

1601-EQ forms shall be filed not later than the last day of the month, following the end of taxable quarter during which the withholding tax was made.

Please note that your tax forms will be forwarded to the BIR electronically until 9 pm. Any form submitted beyond that filing deadline will be forwarded within the next business day.

How to file?

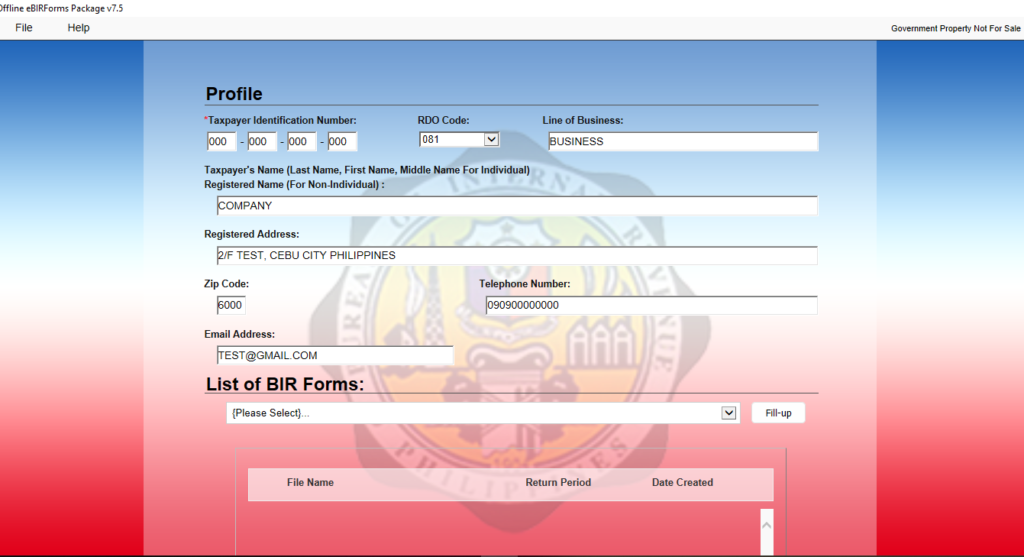

Download the Electronic BIR Forms (eBIRForms) Package v7.5

To download the Offline eBIRForms Package v7.5 click here.

- In your eBIRForms main screen, fill up the TIN, RDO Code, Line of Business, Taxpayers name (for individual) / Registered name (for non-individual), registered address, telephone number and email address.

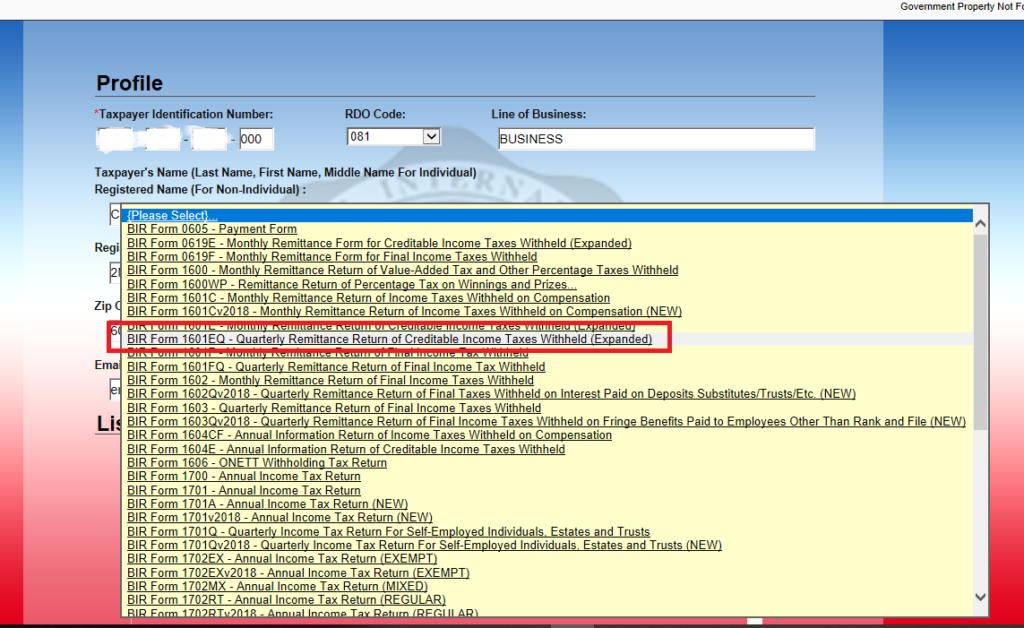

- Select BIR Form 1601-EQ from the List of BIR Forms then click Fill-up.

- Number 2 choose your payment quarter.

- Number 3 Amended Return? Choose NO

- Number 4 Any Taxes Withheld? Choose YES

- Number 11 Category of Withholding Agent, choose Private

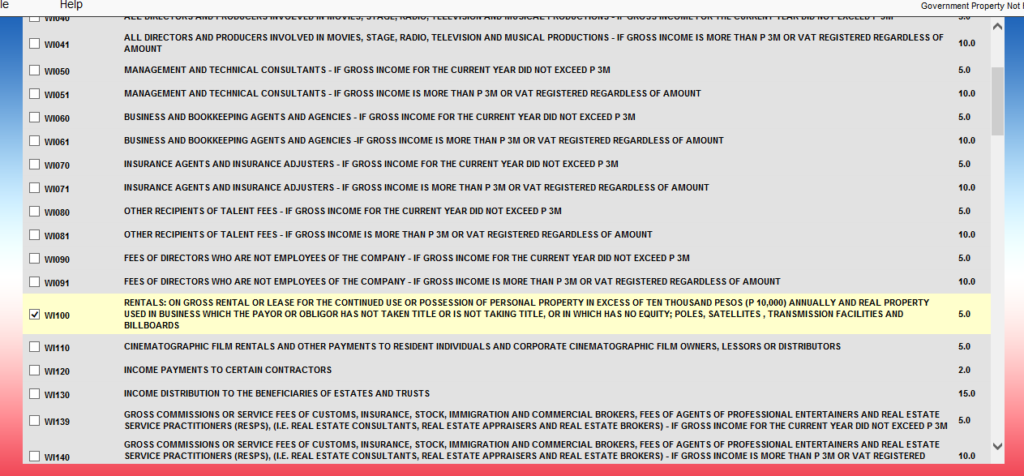

- Part II – Computation of Tax, click ATC and look for WI100 for Rentals and click OK

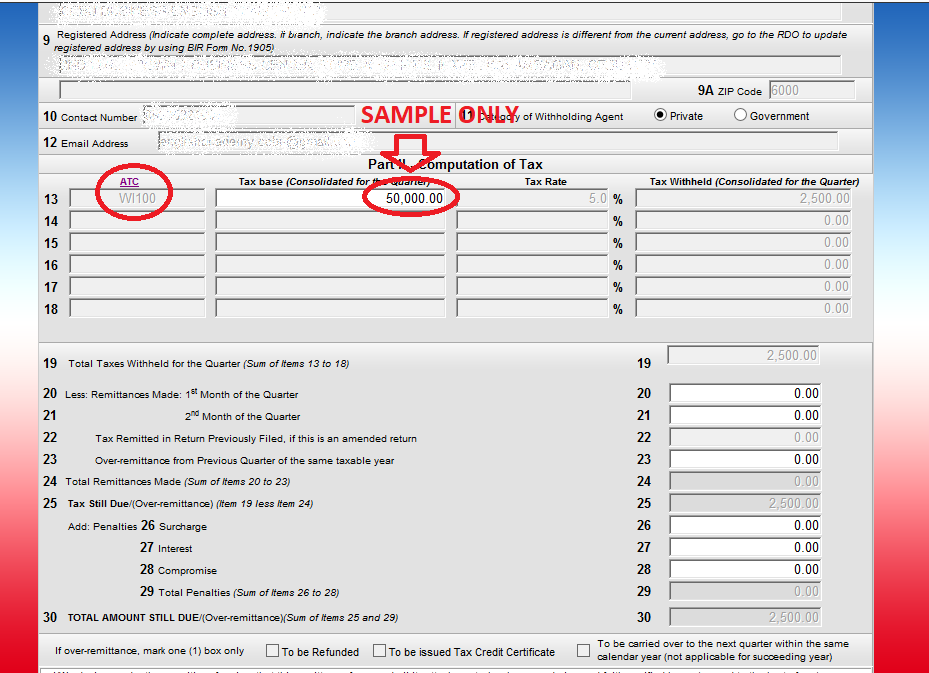

- Number 13 under Tax Base (Consolidated for the quarter) fill in the base amount of your monthly rental.

Let’s say your monthly rental fee is P50,000.

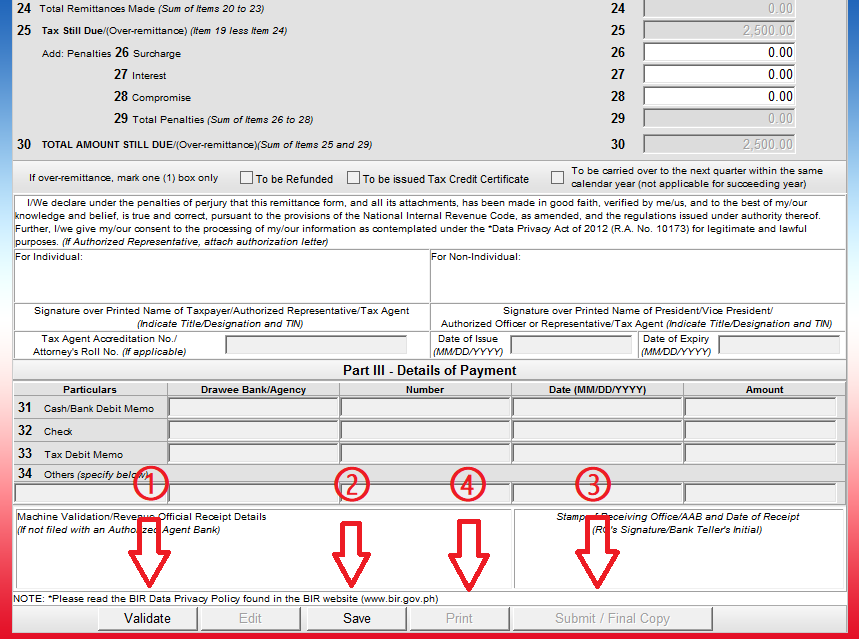

- ① Click Validate

- ② Click Save

- ③ Click Submit/Final Copy

- ④ Proceed to Print

**Note that this form must be printed on A4 Size Paper with 3 copies

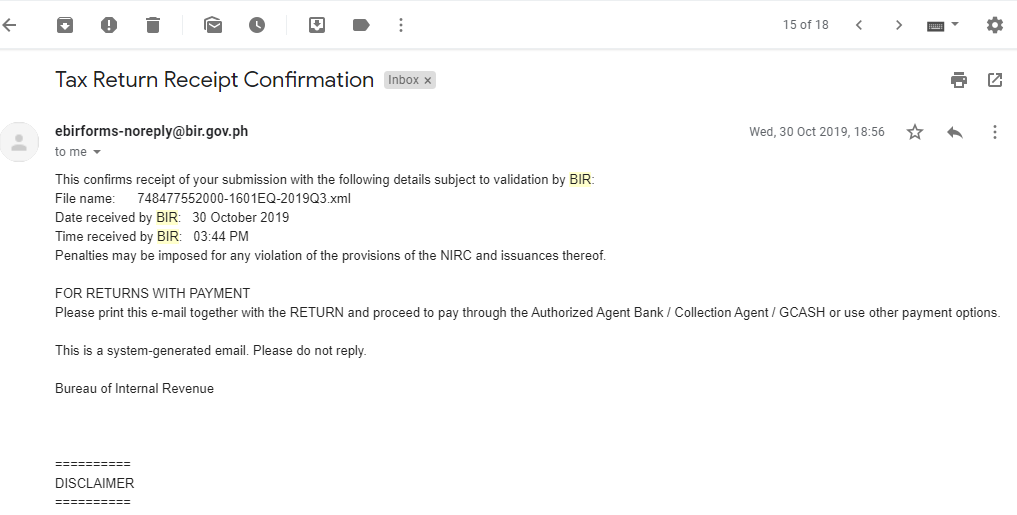

- Once you have filed your return in eBIRForms, you will receive an email confirmation in your registered email inbox. Date and time of reply is based upon the extent of BIR once they have finished examining the return.

IMPORTANT!

All details must be filled out correctly in the form.

It’s better late than never, as they say, but being on time is always the best!

How to pay?

The form shall be filed with an Authorized Agent Bank (AAB) of the Revenue District Office (RDO) or pay online by GCash

Click here for the list of AAB of the RDO near you.

If you are paying through the bank, don’t forget to bring 3 printed copies of the form together with the printed email confirmation from the BIR.

Want to learn how to pay taxes using GCash? Click here.

Want to learn how to file BIR FORM 0619-E? Click here.

Disclaimer

The content provided in this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or the completeness of any information of this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries or any damages from the display or use of this information.